74,000 Jobs from fracking. They’re having a laugh!

“I read the news today oh boy – 74,000 jobs in Blackpool, Lancashire”

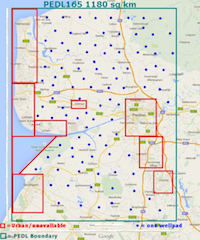

OK well not quite. The Institute of Directors published their “big up the shale” report recently and one of the much repeated headlines was based on the claim that shale gas in the UK could create 74,000 jobs. Specifically the claim was that 100 10-well pads of 40 laterals could create “74,000 jobs in total (direct, indirect and induced – around twice as high as our previous estimate)”. Well, not only twice as high as their previous estimate but 10 times higher that the number of jobs which the previous report which Cuadrilla sponsored – Regeneris’ “Economic Impact of Shale Gas Exploration and Production in Lancashire and the UK” which estimated a high end scenario of 6,600 jobs UK wide from gas extraction by Cuadrilla.

Now bearing in mind that Cuadrilla expect to be able to supply 0.75 tcf a year, and the IoD estimate that total UK production is likely to be between 0.85 and 1.4 tcf it would not be unreasonable to extrapolate from Regeneris’s conclusions that there might be 10,000 jobs at peak (direct, indirect and induced) UK wide as a result of fracking.

So how on earth do the IoD come to their 74,000? We couldn’t work it out so we asked the report’s author, who told us:

Firstly, regarding the Regeneris report, I have not seen the detailed model that lies behind their report, so I can’t really comment. Their report did, however, assume a far lower number of wells (and consequently investment) than our report, so it is not surprising that the job estimates were considerably lower.

Secondly, the UK-level jobs estimate – of 74,000 direct, indirect and induced jobs at peak – presented in our report is actually quite modest when compared with the North Sea (339,000 direct, indirect and induced jobs in 2012, plus 100,000 jobs in the export of goods and services – see p.59 of our report) and the US (605,000 direct, indirect and induced jobs in 2012 – see p.81 of our report).

Thirdly, p.118 of our report explains our estimate of £1 million of capex and opex supporting 20 jobs in total (i.e. direct, indirect and induced). This is based firstly on the North Sea, where £17 billion of capex and opex in 2012 supported 339,000 direct, indirect and induced jobs (not including the 100,000 jobs exporting goods and services) at an average of £50,147 of expenditure per job. And secondly, on the US shale gas industry, where, according to the models developed by IHS, each $1 million (around £650,000) of capex supports 19 jobs in total – direct, indirect and induced. That works out at just over £34,000 capex per job. If you then make an allowance for operating expenditure, a total of close to £50,000 capex and opex per job is also reached.

Firstly we disagree with the conclusion that the Regeneris report has a lower estimate of jobs because it assumed a lower number of wells – what is important in terms of number of jobs is not the number of wells but the number of pads. Drilling more lateral wells from a pad may increase the length of employment but not necessarily the number of jobs.

The Regeneris report assumes 80 well pads and suggests 6,600 jobs. The IoD report assumes 100 pads and suggests 74,000 jobs

Something is awry somewhere there we think.

So what about this calculation which suggests that you can predict the Capital and Operational expenditure and divide each £1 million invested by 20 to get an accurate estimate of jobs? The author seems to think that the fact that he can get this 20 jobs per £ million invested from both the UK offshore and USA onshore data it must be valid for UK onshore. Frankly this is preposterous.

It is estimated that drilling costs (and therefore investment in Capex and Opex) off shore are between 10 and 20 times what they would be on shore. A conservative estimate by the UK Parliament Energy and Climate Change Select Committee suggest that “Offshore well costs are typically a factor of 10 higher than comparable costs for an onshore well”. meanwhile as reported in Canada – “Drilling offshore is extremely expensive, 10 to 20 times more than drilling onshore,” said Larry Hughes, a Dalhousie University professor who researches energy security.

This is one reason why nobody is currently looking to exploit the large shale gas reserves under the Irish Sea.

If investment costs are indeed 10-20 times as high offshore then logic suggests that the same investment onshore should generate 10-20 times as many jobs. The IoD should therefore be predicting a huge jobs bonanza of between 3/4 million and 1.5 million jobs. Curiously they are not doing so. Maybe that would be stretching our credulity a bit too far?

What about the USA figures – well Greenpeace suggest that “The IEA believes extracting the gas in Europe is between two and three times more expensive thanks to different geology and regulation.”

Using the same logic if we have to invest 2 to 3 times more then our employment rates would fall to between 6 and 10 jobs per £1 million invested.

To put it another way, using the jobs per £1 million invested data from USA onshore and UK Offshore but modifying it to take the necessary account of relative cost structures could give you a range anywhere between 6 and 400 jobs per £1 million invested. This is such a wide range as to be demonstrably meaningless.

Another illustration of the serious flaw in this logic is the suggestion in the report that a 40 well pad would result in 3 times the number of jobs that a 10 well pad would and for 5 years not 2. This is clearly out of line with reality as you don’t need many, if any, more people to drill the extra 30 wells. You just need the same people for longer. Extrapolating using the capex/opex calculation does lead to this sort of curious prediction though.

So do we believe the IoD estimates? No. We believe that even the Regeneris report may be overstating the case by predicting 2,500 jobs at the Lancashire level. We think that to get anything like a reliable estimate of employment potential you need a far more scientific method than this crude expenditure divisor.

If we have misunderstood something, and the IoD respond to our further queries with something more meaningful to substantiate their claims we’ll be sure to let you know, but until then we suggest a large pinch of salt should be taken before swallowing the employment predictions in the IoD’s report.