EUR having a laugh aren’t you ?

Our old friend Ben Webster – the Times’ fracking sage – reported recently on Cuadrilla’s tests from their PNR well which were “very encouraging”. He told us:

Cuadrilla said that the results were in line with estimates in 2013 by the British Geological Survey for the Bowland Shale under northern England.

Cuadrilla expects today to start drilling Britain’s first exploratory horizontal shale well and has permission to drill up to four at the site. The company’s tests suggest that each well could extract enough gas to meet the needs of 5,000 homes for 30 years.

Hmm OK then let’s dig a little shall we (you know like journalists used to do before they just republished press releases)?

According to OFGEM the average home in the UK uses around 12,000 kWh of gas each year (using the medium assumption)

12,000 kWh is equivalent to about 39,369 cubic feet of natural gas

So Cuadrilla seem to be saying that from each well (presumably they mean each lateral) they expect their Estimated Ultimate Recovery (EUR) to be 39,369 x 5,000 x 30 or 5.9 billion cubic feet (bcf).

This 12,000 kWh , by the way, is a reduction on historic averages (source https://www.ovoenergy.com/guides/energy-guides/the-average-gas-bill-average-electricity-bill-compared.html)

If we used an average of about 15,000 kWh the EUR would be commensurately higher at an eye-watering (or lip-smacking if you are Cuadrilla perhaps) 7.4 bcf.

If we used an average of about 15,000 kWh the EUR would be commensurately higher at an eye-watering (or lip-smacking if you are Cuadrilla perhaps) 7.4 bcf.

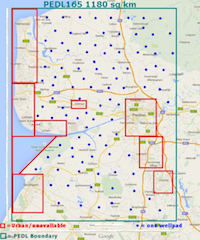

This would mean that (assuming they believe these results could be replicated across the PEDL licence area) with the 100 x 40 well pads they are on record as wanting to wanting to develop, they could extract 23 Trillion Cubic Feet (tcf) of gas, which very conveniently is about the amount (20 tcf) they have been claiming to be able to extract. (Or nearly 30 tcf if we used the 15,000 kWh average!)

If you were to take 20 tcf, divide is by 4,000 wells you would get and EUR of about 5 bcf each. If you translated this to houses worth of gas over 30 years you would then get about 5,000. Of course Cuadrilla’s assumptions are based on core samples and not convenient arithmetic aren’t they?

Less conveniently the suggested EUR figure is almost twice the 3.2 bcf per well suggested by shale gas PR Corin Taylor in the Cuadrilla sponsored IoD report from 2013.

How does this compare to the US experience?

Well every year the US Energy Information Administration (EIA) re-estimates initial production (IP) rates and production decline curves, which determine estimated ultimate recovery (EUR) per well and total technically recoverable resources (TRR). Their publication in 2017 is based on data as of January 2015.

Looking at “Table 9.3 U.S. unproved technically recoverable tight/shale oil and gas resources by play (as of January 1, 2015)” we can see the average EURs by play within each region for natural gas.

If we sort the plays into ascending order and compare it with what Cuadrilla seem to be claiming we can see that, first of all, the vast majority of plays have EURs less than 1 bcf / well and only 1 play (Haynesville-Bossier-LA ) has an average EUR greater than 3.

If we compare the data with Cuadrilla’s claim it is evident that they must really have had some super special results for them to be claiming average EURs in the order of 6.

Now we accept that we can’t read across exactly from the US experience, but this difference is so massive that the Booths store at Penwortham must have sold out of champagne as all of the Cuadrilla execs blew by from the office to get some celebration juice.

Bottoms up! It’s a miracle!

(And of course we know from their rugby pitch analogy just how exact they like to be when it comes to figures!)