Please Sir! I want some more

AJ Lucas have their bowl out again and are asking their investors for more cash. Last time they did this was back in January 2018 and we reported on that at the time.

The idea of the offer is pretty straightforward – you are offered a number of shares for each share you currently own (19 for every 20 here) and you can either buy them or not. You can also ask for a higher allocation subject to eligible shareholders not taking up their full entitlement. There is a sting in the tail here though for existing shareholders who do not participate in the new equity round proportionate to their shareholding, as that shareholding percentage will now be diluted.

This “offer” is aimed at raising AUD$ 46,300,000 from the sale of shares at AUD$ 0.065 each. This constitutes a new tranche of 712,600,000 shares. This almost doubles the number of shares that currently exist. Last time they did this they only had to sell 97,500 shares to raise AUD$ 31,200,000 but that was when the shares were worth AUD$ 0.32c each.

The Institutional (non-retail) part of the offer is already partly subscribed. Kerogen Investments No.1 (UK) Limited who own 53% of the company have agreed to take up their entitlement in full this guaranteeing AUD$ 24.7 million from the exercise. However this will not directly increase available cash as “proceeds from Kerogen’s participation in the Offer of $24.7 million will be used to reduce Kerogen’s subordinated debt facility”. Just as last time then It seems therefore that Kerogen won’t actually be parting with any real cash but will simply be writing off debt in exchange for a larger share of the AJL business.

AJL expect a take up of just 1/3 to 2/3 giving a total gross proceeds of AUD$ 34.8 million. This would mean that just over half a million new shares would be sold meaning that there would be just over 70% more shares than there are currently. These new shares will have been purchased at 28% discount to today’s price of AUD$ 0.09c.

Gross proceeds from the Offer are estimated to be between $32.5m and $37.0m based on Kerogen’s take up of its entitlement and assuming c.36% and c.57% take up 2 of the remainder of the Offer respectively (including through the retail over allocation facility), with a midpoint of $34.8m ( Indicative Offer Size)

After the costs of the exercise (AUD$ 0.6 million) the net proceeds of the capital raising will thus be AUD$ 9.6 million

How will it be used?

Net cash proceeds after fees & expenses will be applied to:

₋

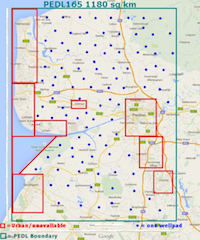

Meet AJL’s share of future commitments to UK investments including to meet costs associated with the ongoing flow test of the

second Preston New Road well (PNR 2) and the appraisal of other prospective sites

₋

Fund any investment required to grow the Australian drilling business

₋

Balance to fund general corporate costs and/or service debt

It is not clear whether Centrica’s £46,700,000 Contingent Carry payable after the flow testing of gas for six months will be met. Presumably Centrica expected a flow test from a fully fracked well when this condition was set. Centrica do have an option to escape from their investment and it would seem that if they do that £46.7 million will be forfeited. Ouch!

Under the agreement, Centrica also holds a put option to sell back its equity interest in the Bowland licence to Cuadrilla and AJL for a nominal consideration. In the event that Centrica exercises the put option, the contingent carry amount would be forfeited.